AI in Insurance Industry

Reduce the time and cost for managing claims processing and underwriting with Computer Vision and NLP.

Reduce the time and cost for managing claims processing and underwriting.

Computer vision and AI help to simplify and streamline the property assessment, risk analysis and post damage assessment process. Using Clarifai’s image recognition, reduce the time and cost for assessing and underwriting claims. Ultimately improving the collaboration between agents and customers for a better customer experience.

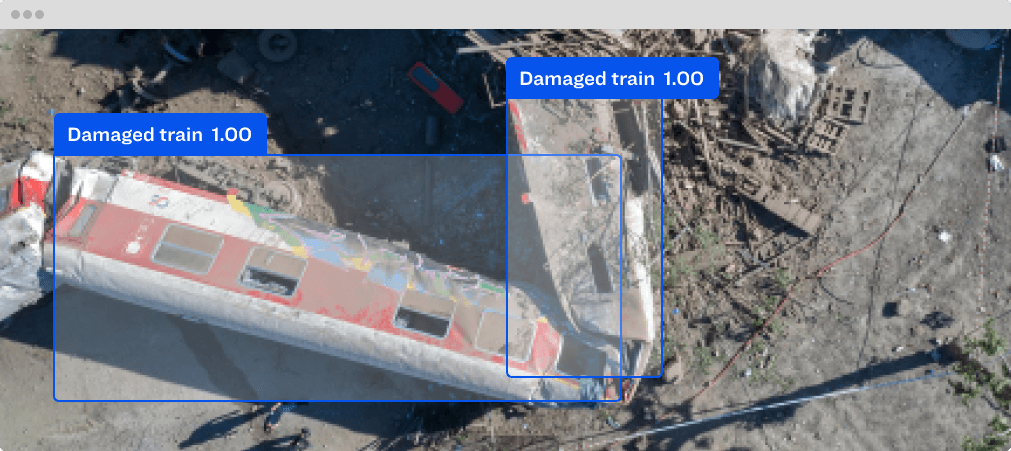

Analyze natural disaster damage faster

Manage risk and reduce costs using computer vision to aid in processing damage assessment. Use aerial imagery and geospatial applications to assess property damage throughout the evacuated areas. Identify homes that have been completely destroyed or even partially damaged. Prevent fraudulent claims of damaged property from weather-related events.

Standardize and accelerate the vehicle damage assessment process

Use computer vision to recognize and analyze the extent and location of damage to a vehicle to determine the correct insurance claims amount. Reduce the time it takes for customers to receive their payouts and avoids claims leakage, saving insurers money.

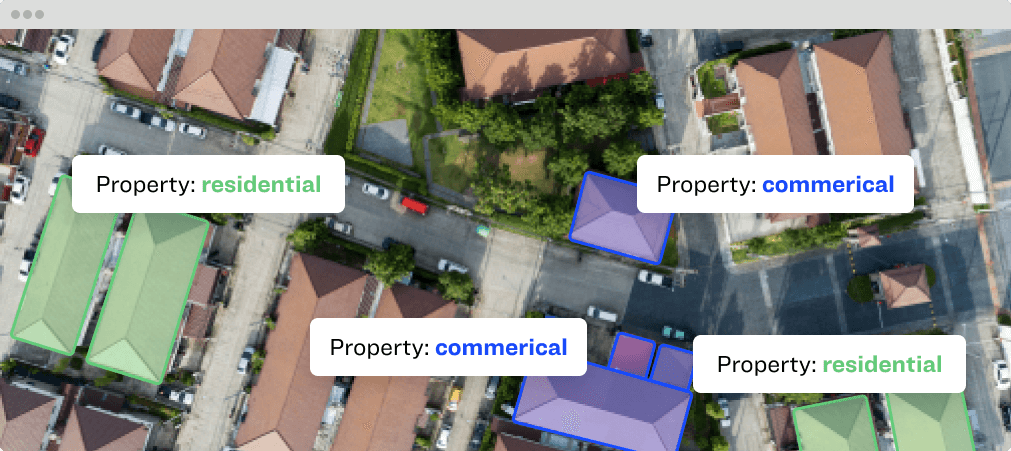

Identify commercial and residential property features

Use computer vision and satellite imagery to detect presence of pools, trampolines, flood lines and upgrades that affect property values. Identify and classify roof types, parking lots and facades and signage. Better manage risk and for personal and commercial businesses applying for reinsurance.

Mitigate underwriting risk

Analyze text from applications, social media, online news sites, medical and police records to locate any red flags that would impact the final claim evaluation. Evaluate data as a whole to observe trends and spot individual and group fraud.

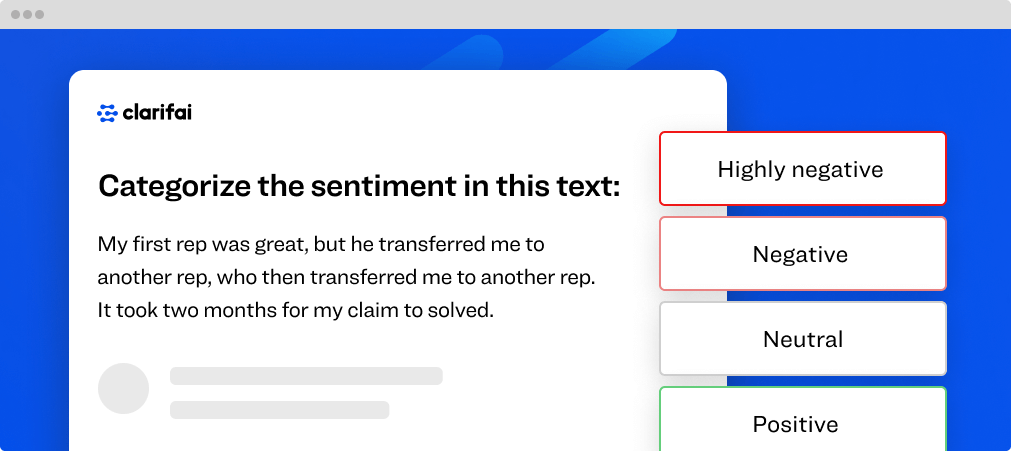

Improve customer service

Use NLP to recognize the intent within text data to respond to questions from customers. Identify multiple sentiments and events within one customer service call. Improve customer service and provide better buying experiences.

Benefit from an integrated AI-lifecycle platform combining computer vision, NLP and OCR.

Reduce settlement time

Validate claims in real-time and expedite claim settlements often after the First Notice of Loss.

Lower cost per claim

Reduce contact center costs, time spent in the field and customer churn.

Improve appraisal accuracy

Reference masses of historical data to deliver accurate appraisals and calculate insurance premiums.

Process claims faster

Validate and process claims faster than ever without the need for staff augmentation.

Reduce fraudulent claims

Use facial and image recognition, video geolocation and time stamps to reduce risk.

Enhance customer satisfaction

Make the claims review process faster and reduce claim approval wait times.

Computer Vision AI Solutions for Insurance

Transform claims and underwriting processes with Clarifai's Computer Vision and AI solutions.